Intro to Accruals

Summary

This document addresses work instructions on viewing Accruals.

Accruals

The Accruals page displays a quick overview of an employee's benefits or time off balances.

Types of Benefits Tracked

There are three types of benefits tracked within the system:

- Paid, non-worked time such as sick or vacation days (typically tracked as hours).

- Unpaid time off such as a leave of absence (typically tracked as hours).

- Monetary allowance such as clothing or meal allowance (typically tracked as dollars).

For employees to obtain these benefits, the benefits can either be entered and tracked manually or configured to automatically accrue hours or dollars as an employee meets specific eligibility criteria. These two different methods are called “Decremented Benefits” and “Accrued Benefits,” respectively.

Decremented and Accrued Benefits

Decremented benefits refer to a manual process that managers can perform to credit and debit benefits. These include manually maintaining benefits that have balance limits and those that typically do not have set limits such as jury duty or bereavement time.

Accrued benefits are configured to evaluate conditions then trigger automatic credits or debits to time off bank balances

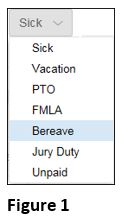

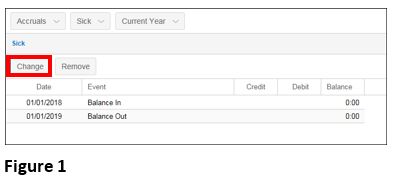

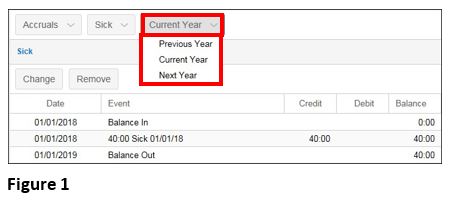

Note: The system allows for tracking the usage of benefit time for up to 10 benefit categories (Figure 1).

To Access the Accruals Through the Employee Page:

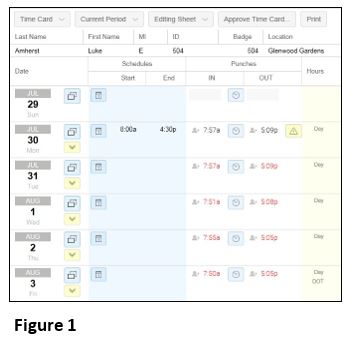

1. Access the employee timecard (Figure 1).

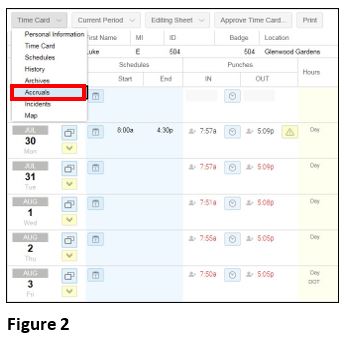

2. Click Accruals from the drop-down menu (Figure 2).

The Accruals page may be used to view, credit or debit time off balances.

To View Additional Accruals:

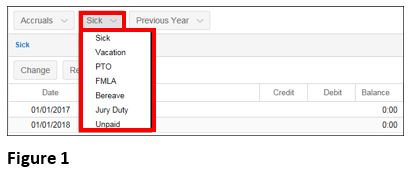

1. Click on the accrual benefit button (in the following example, Sick is the accrual benefit button) (Figure 1).

2. Select the desired accrual from the drop-down menu.

To Modify the Accrual:

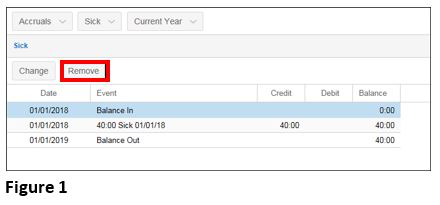

1. Click Change (Figure 1).

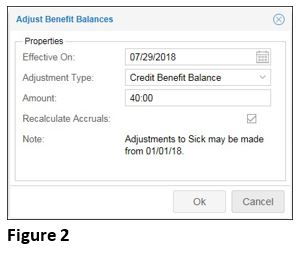

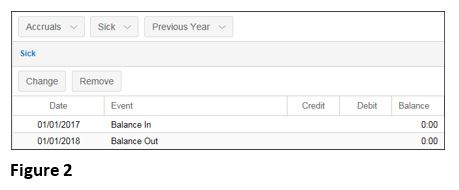

2. The Adjust Benefits Balances window will appear (Figure 2).

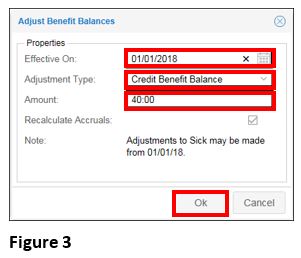

3. Enter the Effective On date (Figure 3).

4. Select the Adjustment Type from the drop-down menu. Select Credit, Debit, or New Benefit Balance.

5. Enter the Amount of the adjustment.

6. Make sure Recalculate Accruals is checked.

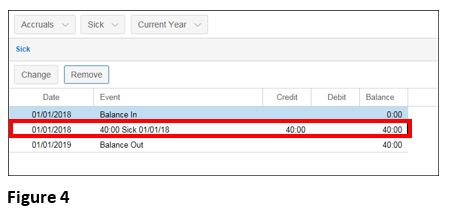

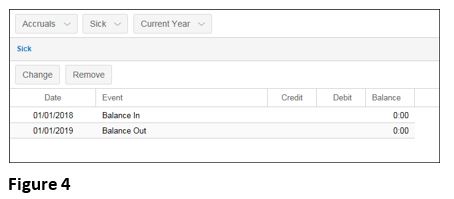

7. Click OK and the Accruals window will be updated with the benefit (Figure 4).

To Remove the Benefit Adjustment:

1. Click Remove (Figure 1).

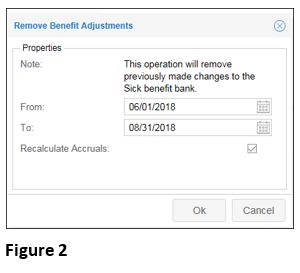

2. The Adjust Benefits Balances window will appear (Figure 2).

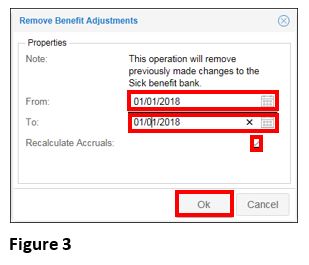

3. Enter dates in the From and To fields to remove the accruals (Figure 3).

4. Make sure Recalculate Accruals is checked.

5. Click OK and the Accruals window will be updated with the benefit (Figure 4).

To navigate between accrual periods:

1. Click on the period button (Figure 1).

2. The selected period accrual information will appear (Figure 2).